Build a Business That Qualifies for Capital, Scales with Systems, & Leaves a Legacy!

From startup to succession-ready, We help you get your structure, strategy, and systems right — from day one!

Let Me Introduce Myself...

Hey Suga,

I’m a Financial Empowerment Consultant with over 20 years of experience helping business owners go from hustle to high-performance.

With a double master’s in Adult Education, plus graduate degrees in Entrepreneurship and Leadership, I bring both academic and street-smart expertise to help you build a real business — not just a side hustle.

I specialize in:

Business Formation & Structuring

Strategic Mentorship & Technical Assistance

Financial Empowerment Coaching

Systems Development

Instructional Design

Legacy Planning

Web Design & Digital Branding

Whether you're launching or leveling up, I help you work smarter — and build a legacy worth leaving!

Let’s Fix the Gaps in Your Business

Structure, Systems, & Strategy!

I help you turn your business into a fundable, scalable, and succession-ready asset — not just a side hustle!

Business Development

Most business owners are great at what they do — but struggle to structure it in a way lenders trust, systems support, and successors can sustain.

That’s where I come in...

🔹 Lender Compliance Education — Become bankable

🔹 Technical Assistance & Automation — Get systems in place

🔹 Organizational Development — Build from the inside out

🔹 Succession Planning — Prepare to grow and eventually exit

Choose Your Pathway to Mailbox Money

🟦 Legacy Lab™

(Group Coaching)

Join me & my NoMore925 Global Community of Entrepreneurs & Investors inside my Legacy Lab, where I lead monthly mentorship sessions. This is where strategy meets structure — in a collaborative setting with entrepreneurs ready to grow.

Live mentorship sessions with Jaclynne & industry experts 3x a week

Access to expert-led trainings and funding education

Community support and tools to help you stay lender-ready

💸 Investment: Budget-friendly $50 monthly membership via NoMore925

🟨 Mailbox Money Mastery™

(Private 1:1 Mentorship)

A 52-Week private mentorship program for founders ready to go deeper, faster. You’ll work with me 1:1 every week to scale your systems, align your structure, & position your business for profit or exit.

Weekly 1:1 sessions

Personalized business audits & dashboards

Full roadmap execution with private support

Includes a Free Business Scan

📩 Limited capacity. Application required.

Studio 52™

(My Trading Lab)

Join Studio 52 – My Trading Lab for just $50/month and learn the exact strategies I use to move smart, not scared. Turn your screen time into skill, your skill into income, and your income into freedom.

✨ Because in Studio 52, we don’t chase money — we master it.

Live mentorship sessions with Jaclynne & industry experts once a week

Access to expert-led trainings and trading education

Community support and tools to help you

💸 Investment: $50 monthly membership

Do You Want My Complete

Sales & Marketing System?

Not Sure Where to Start? Let's Talk Suga

If you’re tired of wasting time and ready to finally make smart, strategic moves in your business — let’s connect.

Whether you’re new to business or overdue for structure, I’ll help you get clarity and chart a custom roadmap forward.

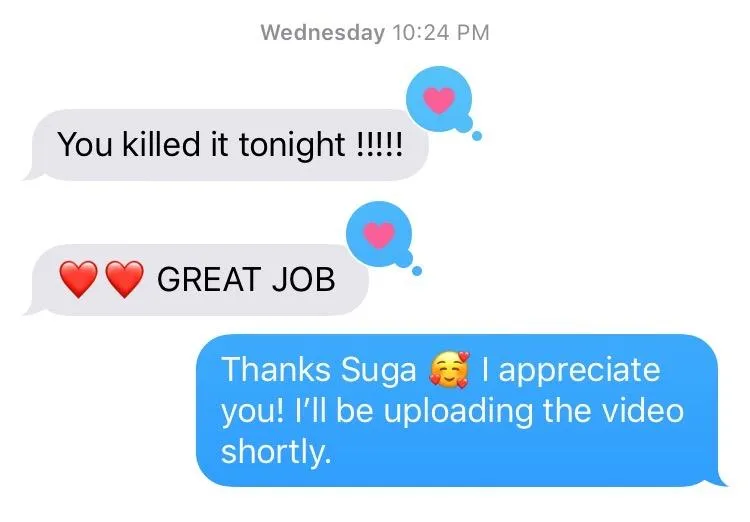

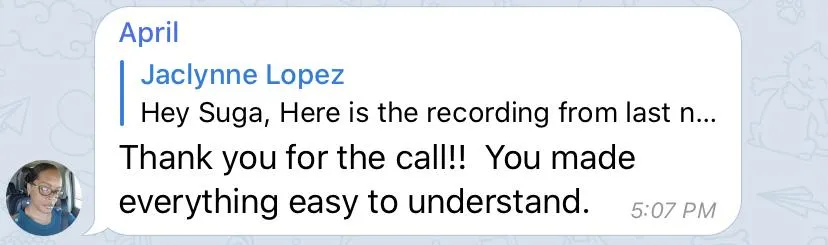

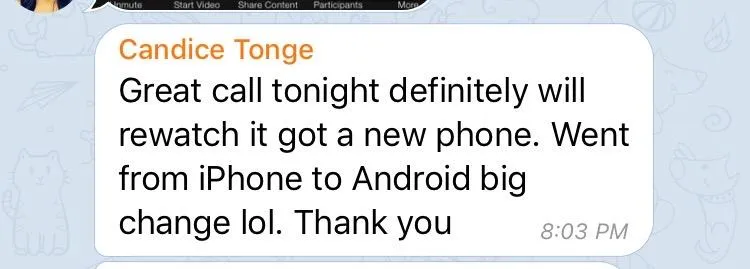

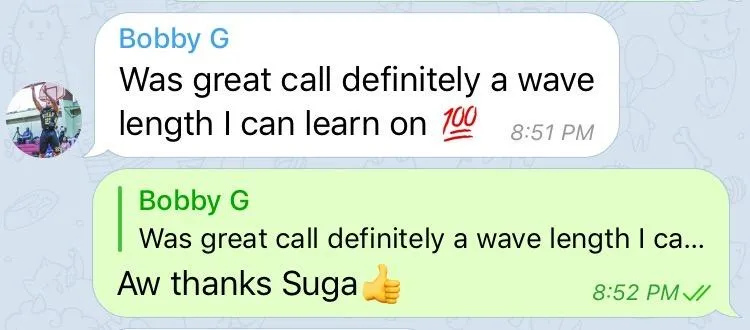

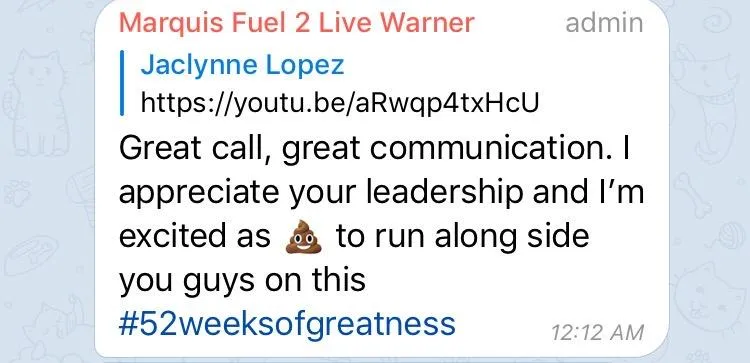

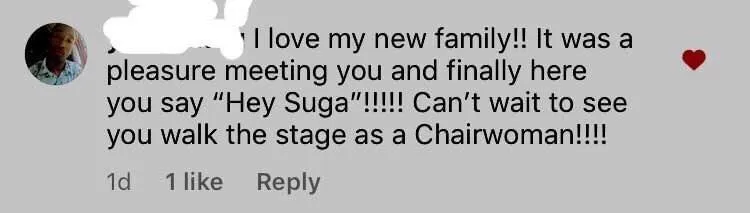

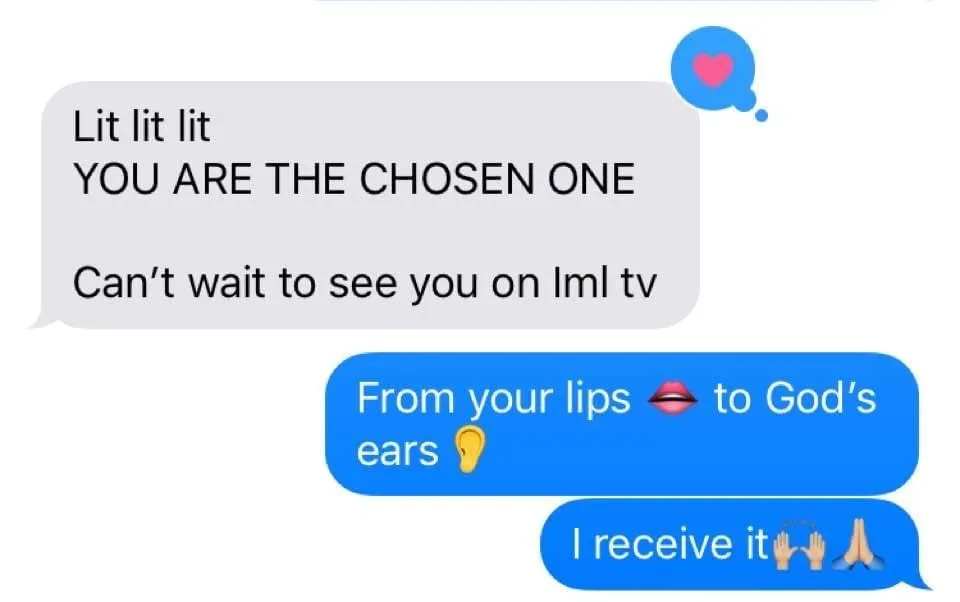

My Study Buddies Success Stories

FAQs

Your Questions Answered: Insights for Business Success with Jaclynne.

What kind of businesses does Jaclynne work with?

Jaclynne works with startups, small businesses, and established entrepreneurs across industries. Whether you’re just forming your LLC or restructuring after years in business, we help you build the infrastructure to scale and succeed.

Do you offer credit repair services?

No — I do not offer credit repair specifically. I focus on financial education, lender compliance, and technical assistance to help you structure your business properly so you can you build a fundable business. My goal is to help you become lender compliant and fundable — not just fix your score! That said, I can point you in the right direction and connect you with trusted resources if you need help improving your credit profile.

What’s the difference between Mailbox Money Mastery™ and Legacy Lab™?

Legacy Lab™ is a group coaching program built around my 5-Level Roadmap — great for business owners who want guidance, community, and weekly strategy sessions. Mailbox Money Mastery™ is a private 1:1 mentorship container for entrepreneurs ready for deep, customized, high-touch support with weekly coaching and personalized audits.

How do I know which service or program is right for me?

Start by booking a free strategy session. I’ll help you assess where your business is now, what gaps need to be closed, and whether a course, coaching, or technical assistance is the right move.

Are your services tax-deductible?

In most cases, yes — if you're a business owner, coaching and consulting services related to your operations are often deductible. Please consult your tax specialist and financial advisor to confirm your eligibility.

What results can I expect from working with you?

Clients often walk away with:

* Full business structure & SOPs

* Lender-ready compliance and documentation

*Confidence in their systems and operations

*Access to funding they previously didn’t qualify for

*More time, more clarity, and a path to residual income

Results depend on implementation — but the right structure changes everything!